Coinbase

- 1. What is Coinbase?

- 2. Trading

- 3. Staking

- 4. Fees, Banking & Payment Networks

- 5. Getting started with Coinbase

- 6. Is Coinbase Safe?

- 7. Summary

Table of Contents

What is Coinbase?

Coinbase is one of the largest US based crypto currency exchanges that has over 150 crypto assets listed and boasts almost 100 million users worldwide. The company operates multiple platforms, regular Coinbase aimed at beginners just starting out and Coinbase Pro for more experienced traders.

The company has been operating since 20 June 2012 and is a publicly traded company. As such is subject to additional scrutiny above and beyond many other crypto firms. Its long history and proved track record of security make Coinbase the first place many new users go to get involved in crypto for the first time.

Coinbase Trading

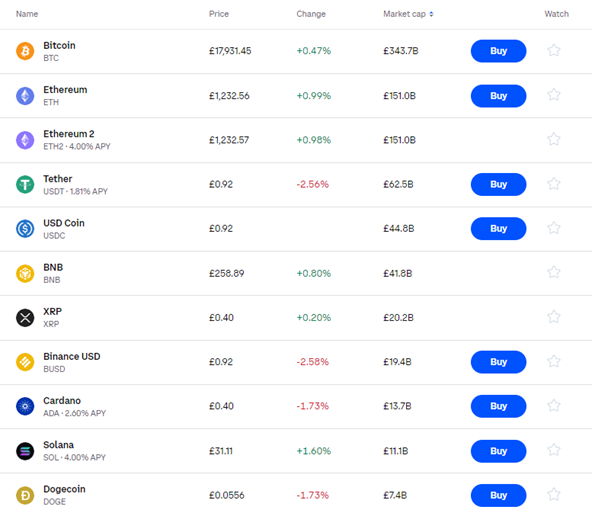

Coinbase and its mobile app continues to be widely used by the crypto participants and its simple design makes it easy for new users just getting started. It’s possible to easily Buy, Sell and Convert cryptocurrency between any of the supported fiat currencies or for other listed crypto assets. A quote will be shown, and fees displayed for the order and once accepted it is processed and balances will automatically update once completed. The Coinbase app has been the most downloaded app on the app store on more than one occasion during periods of time with high interest and attention on cryptocurrencies.

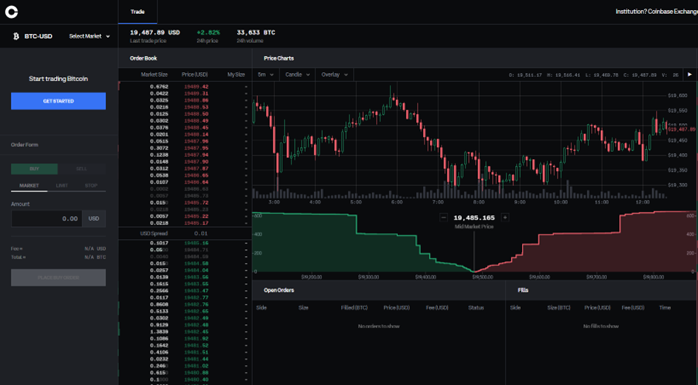

Coinbase Pro on the other hand provides users with far more trading tools and capabilities as well as having cheaper fees than regular Coinbase. It’s possible for users to connect their bank accounts to deposit and withdraw funds directly making it quick and easy to trade. Coinbase Pro is primarily aimed at more experienced traders looking to take advantage of the direct fiat to cryptocurrency trading pairs.

Coinbase Staking

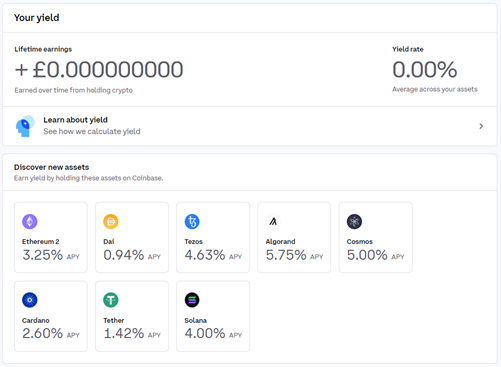

Coinbase currently supports staking for 8 of its listed crypto assets and users can earn a yield for holding a balance of coins within their account. The APY may vary depending on market and network conditions, but these variable rates will be paid to your account for engaging in staking. It is worth mentioned however that the pay-out rates vary depending on the coin being staked and most are not eligible for daily pay-outs. Coinbase undertakes the staking activity automatically without any technical knowledge or complexity being required for the end user. Staking is unfortunately not yet available on Coinbase Pro but is expected to be launched in the near future.

Learning Rewards Coinbase provides its users with learning rewards from completing tasks and questions related to crypto and blockchain ecosystems. This is not only informative but is a fun way to reward users for engaging with new crypto assets and improving their understanding of the industry. Coinbase collaborates with major coins listed to provide its users with these airdrops for learning which exposed and distributes coins to a wide group of users.

Fees Banking and Payments

Trading

Coinbase’s is not overly transparent when it comes to fees for trading on its normal platform. In fact, the only information explaining how fees are charged is within this Coinbase article still does provide a clear answer per service. We do know that a small minimum fee applies per order and once exceeded a percentage-based fee structure of 1.49% is enforced. If you trade crypto to crypto using the convert feature a 2% fee is charged for the order. Coinbase also states that on top of its fees a spread may be applied to the Cryptoassets being traded meaning that the average price per coin may be higher than the market price at the time of trading. These fees can quickly add up and can make regular Coinbase a more expensive platform though convenient. In contract Coinbase Pro operates based on a maker-taker fee model with different pricing tiers based on the accounts 30 day traded volume. The fees start from 0.6% Taker fees and 0.4% Maker all the way down to 0.05% and 0.0% when trading at the top tier. It also has significantly cheaper deposit/withdrawal fees associated with it for both crypto transactions and payments of Fiat currency.

Withdrawal/Deposit

Incoming transactions to Coinbase or Coinbase Pro are free and automatically credited if sent currently via one of the supported networks. There are instances where Coinbase has been sent coins and altcoins it does not support, and the help given to affected users has been very minimal and refusing to assist with recovery is commonly mentioned within reviews. When sending a transaction from your account to an external wallet address a reasonable withdrawal fee is charged based on the estimated networks fees for a standard transaction. It is worth mentioning that Coinbase likely batches user transactions to save money on fees which is standard for a lot of exchanges so no need to worry if you see this on a block explorer. This comes at no cost or inconvenience to the user as the transaction is still publicly broadcast arrives to its destination in the same amount of time.

Fiat and Banking

Coinbase supports a much wider selection of fiat currencies than Coinbase Pro, as it operates across the globe in many jurisdictions. Through integrations with many major financial institutions and payment networks such as Visa and Mastercard Coinbase makes it easy for users to transfer funds using traditional finance options. It is even possible to use Coinbase with PayPal, and which is not possible with many other crypto exchanges. Coinbase Pro only supports 3 major fiat currencies GBP, EUR and USD which have direct trading markets against most of the crypto assets listed. Trading is available and deposits supported in GBP and EUR for UK and EU customers and USD only available for US customers. Unlike Coinbase bank transfers are the only payment method supported.

Supported Assets (Click to minimize)

![]() Bitcoin

Bitcoin

![]() Ethereum

Ethereum

![]() Tether

Tether

![]() USD Coin

USD Coin

![]() Binance Coin

Binance Coin

![]() Dogecoin

Dogecoin

![]() Cardano

Cardano

![]() Solana

Solana

![]() Polygon

Polygon

![]() Polkadot

Polkadot

![]() Shiba Inu

Shiba Inu

![]() Dai

Dai

![]() Avalanche

Avalanche

![]() Cosmos

Cosmos

![]() Litecoin

Litecoin

![]() Chainlink

Chainlink

![]() Stellar

Stellar

![]() Algorand

Algorand

![]() Near Protocol

Near Protocol

![]() Quant

Quant

![]() Hedera Hashgraph

Hedera Hashgraph

![]() Sandbox

Sandbox

![]() Theta Network

Theta Network

Networks

Coinbase and Coinbase pro both support the same crypto assets with 179 different cryptocurrencies currently available. Though many leading altcoins are supported, Coinbase has far fewer than other cryptocurrency exchanges likely due to the regulatory complexity that is required for it list a new asset. This does mean however that the assets supported by Coinbase tend to have been thoroughly vetted before listing and this can give users greater confidence in the project.

Getting started with Coinbase

Verification

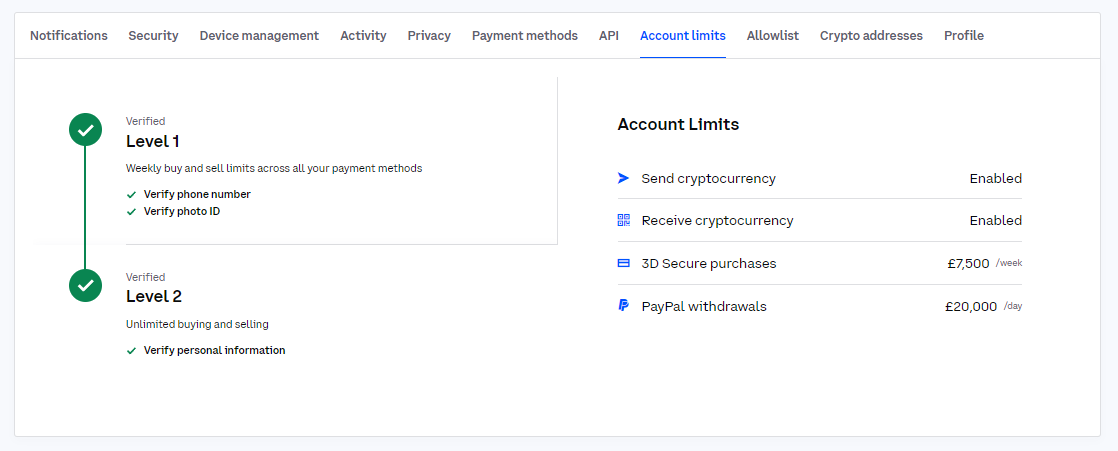

Coinbase like all regulated crypto exchanges require users to complete KYC verification before being authorized to use their services. A valid government issued ID such as Drivers Licence of Passport must be uploaded and verified alongside a selfie and an image of the user holding up their ID document. Once the details have been reviewed by Coinbase which tends to take only a few minutes the users account is approved. It is possible to further verify you account to increase deposit and withdrawal limits by verifying your personal information providing a Proof of Address document. Coinbase Pro is subject to the same verification process however it is possible to achieve much higher deposit/withdrawal limits. Users may be required to provide information and supporting documents relating to their income sources to verify the legitimacy of funds being used to trade.

Limits

On the regular Coinbase platform there are weekly limits imposed based on the verification level of the account and the time it has been open and previous activity. It is possible to increase limits by trading and using the platform up to a maximum of £7,500 per week via regular orders via card and bank transfer. There is a separate limit for PayPal which can increase to as much as £20,000 per day. Coinbase Pro does not have the same limits as Coinbase with higher daily limits than the regular platform. There are far fewer payment methods available though and user bank accounts must be linked and verified to deposit or withdraw funds.

Supported Countries

Coinbase is currently operational in 106 countries across 6 key global regions, North and Central America, South America, Europe, Asia, Africa, and the Middle East. The list of supported countries is ever growing with more countries waiting or pending government of regulatory before Coinbase can be launched. It is possible to view a full list of countries supported by Coinbase by clicking here. Coinbase Pro supports far less countries due it being a more professional platform. The emphasis on only supporting USD, GBP and EUR limits its global reach and potential users as without these fiat currencies and associated banking and payment networks using the platform may be of some difficulty for users.

Is Coinbase Safe?

Regulation

Coinbase is regulated to engage in money transmission in most US jurisdictions having obtained many licenses to operate at state level. It is registered as a money service business with Fincen and is required to complete with many financial services and consumer protection laws. Outside of the US CB Payments registered in the UK is regulated by the Financial Conduct Authority under the Electronic Money Regulations. It is safe to say that Coinbase complies with all financial requirements and obligations imposed by regulators to enhance the protection of users.

Security

Coinbase requires users to verify their phone number enforcing 2 factor authentication from the beginning of the account’s creation. This positive feature keeps users protected and gets them used to account and asset security which are incredibly important when engaging with cryptocurrencies for the first time. It is also possible to enable further security measures such as IP and wallet address whitelisting and biometric protection on the app. The history of Coinbase is long and its reputation for ensuring customer funds are kept safe is one of the best within the industry. Since its inception several other high-profile companies have been compromised such as Mt. Gox, Binance and many others though Coinbase has not experienced the same fate. Coinbase states it keeps 98% of customer assets offline which helps to reassure users that security is one of its highest priorities.

Reviews & Reputation

Coinbase has a claimed Coinbase Trustpilot profile that is currently rated 1.6 out of 5. As with many large crypto exchanges their review profile is repeatedly bombarded with fake and fraudulent reviews attempting to scam readers. That being said there are many legitimate reviews both good and bad though it is more common to see complaints as users feel the need to voice their concerns when encountering and issue or loss that be significant. It is worth mentioning that as a centralised exchange Coinbase does have the ability block or freeze a user’s account which can leave people without access to their assets. It’s been reported within many reviews and social media posts that this sometimes can occur without much transparency or justification from Coinbase. It should be said that this can happen to any platform that holds assets on behalf of its users when it believes the terms of service have been broken or due to external legal factors.

Summary

Coinbase is a great first platform as it is designed with simplicity in mind for new users with no previous crypto experience or knowledge. Its outstanding reputation as a highly trusted exchange for retail and corporate clients coupled with extensive safeguards and regulation makes Coinbase a very safe option to use. They do however not provide access to the broadest selection of Cryptoassets and some key services such as Staking, DeFi and yield farming are also lacking in features.