KuCoin

- 1. What is KuCoin?

- 2. Trading

- 3. Staking

- 4. Fees, Banking & Payment Networks

- 5. Getting started with KuCoin

- 6. Is KuCoin Safe?

- 7. Summary

Table of Contents

What is KuCoin?

Kucoin was initially created as “The Peoples Exchange” in September 2017. The company is headquartered in Singapore and registered in the Seychelles though it does not currently report to any financial regulator. With over 8 million users worldwide and supporting almost 700 crypto assets, KuCoin is one of the leading exchanges in the industry. The platform has a wide selection of trading and staking tools and services which are aimed at not only beginners but more advanced traders.

KuCoin Trading

Fast Trade

Fast Trade is quick and easy to use function for purchasing crypto Visa, MasterCard, or a fiat balance via one of the many alternative payment methods available. The service is integrated with payment channels Simplex and Banxa and will provide competing quotes to ensure users receive the best rates and offer for their trade. Once the payment has been completed the assets will become available in the main account wallet within Kucoin.

Spot Trading

Kucoin’s Spot trading markets are available to all users and provide access to advanced tools and features suitable for all investors. When trading spot markets, it is important to remember to transfer your assets from main account into the trading account and unlock trading using the 6-digit trading passcode. Another great feature of Spot Trading is that it’s possible to an open multiple tabs and trading pairs making Kucoin one of the easiest platforms to navigate between different markets.

Margin Trading

Kucoin also allows users to engage in leveraged trading activities once the account has completed verification. It is possible to get up to 100x leverage however this carries significant risk and warning messages are displayed to ensure traders are aware of the risk and price of liquidation. There is a simple to use scroll bar that controls the amount of leverage applied to the trade and helpful stop loss and risk management statistics and alerts.

Trading Bot

Kucoin trading bots are free to set up and come with a variety of readymade algorithms for users to take advantage of. This helps to automate some popular trading strategies Dollar Cost Average, Smart rebalance, futures. The only cost of using these tools are the standard account fees incurred for the trading activity.

Convert

This crypto-to-crypto trading service quickly and automatically executes the conversion of one coin for another accounting for all trading pairs and fees. Kucoin states that there are no additional fees to using this trading function based on the spot prices for the underlying assets. This tool can make it easier to process trades where multiple trading pairs and markets may be required. There are however more transaction minimum and maximum limitations, but it can be used multiple times if required.

Derivatives Trading

KuCoin Futures is the platform that enables users to take advantage of and trade derivatives and futures markets. Users must transfer funds from their Main account into their futures account and confirm acceptance to the risk warning before being able to trade. There are perpetual and quarterly futures markets available supported for a wide variety of crypto assets trading against major market pairs with up to 100x leverage.

KuCoin Staking

Kucoin Earn

KuCoin Earn is great service that allows any user to make the most of their crypto assets not in use and earn a variable APY. There is a Flexible interest option where you can redeem your coins at anytime should you seen to sell, exchange or send them free of charge and you keep all the accrued interest. This in effect gives users the same freedom and control as leaving coins in a regular trading account so if you do have assets left with Kucoin it might be worthwhile to put them in Flexible for the extra bonuses. It is also possible to lock your assets for higher returns and yields by using subscribing to one of the Fixed offerings ranging in periods from 7-, 28-, 60- or 90-day contracts. During this period the users’ coins are temporarily unavailable until the end of the contract period when they are returned and credited back to the account plus interest. There are limits to the number of coins that can be subscribed per user to certain offerings most of them being promotional to get new users interested and used to the service. There are plenty of opportunities for users to increase their assets under management and portfolio by using KuCoin Earn.

Crypto Lending

Kucoin provides access and infrastructure for a complex lending and borrowing platform. Users can borrow or lend assets and either receive or be charged and annual interest rate. It is possible to use crypto lending with a wide selection of major cryptocurrencies and the APY varies depending on the coin selected and the staking and rewards.

Spotlight

KuCoin also has its own token launch platform for Initial Exchange Offerings (ICO). As these projects are being promoted by Kucoin to its users a certain amount of due diligence and verification of the project’s legitimacy can be assumed. There is lots of information detailing supply and projects details and rules and restrictions for contributing to the token sale. Kucoin may also go on to provide continued help and assistance to launched projects which is further strength. Including all the relevant launch dates and times as well as token supply, spotlight allocation, hard cap, and token distribution to participants.

KCS Bonus

KuCoin Token KCS is the native cryptocurrency for the KuCoin ecosystem, an ERC20 token on the Ethereum blockchain. Holders with at least 6 KCS are eligible to receive a share from 50% of Kucoin daily trade fee revenues. These rewards are distributed to users daily and is a great incentive for holding KCS.

Fees Banking and Payments

Trading

KuCoin’s fees are tiered and charged based on the 30-day trading volume of the account. The fees for Spot trading market start from 0.1% maker and taker fees for most listed crypto assets within Class A, however there are slightly higher fees of 0.2% or 0.3% for Class B and C respectively. There are cheaper fees charged for engaging in Futures trading starting from 0.02%/0.06% for Class A listed assets. KuCoin and its third-party partners charge 3.8% for card payments however there may be a spread applied depending on the size of the order and the selected crypto asset. This does make it an expensive method of choice and as the only fiat gateway into KuCoin users are left with few other options. It is also possible to receive a 20% discount on fees charged by enabling discounted fees paid in KuCoin’s native cryptocurrency KCS.

Withdrawal/Deposit

Kucoin states that it supports free deposits, though this is only true when depositing crypto and not Fiat currencies. Sending crypto out from Kucoin is simple and straightforward process and a withdrawal fee is charged like many other platforms. The mining or transaction fee is charged based on the prevailing market and network conditions at the time of submission. The fee is taken from the balance of available coins unless the entire balance is being sent in which case it is deducted from the total transaction amount.

Fiat and Banking

Although is it possible to use over 50 fiat currencies to purchase crypto via Fast Trade, at the time of writing, it is not currently possible to use bank transfers of any kind to deposit or withdraw funds from the platform. This greatly impacts the cost and ease of access for Kucoin users onboarding using major Fiat currencies including USD, EUR, and GBP. Though 70 different payment methods are supported these do tend to be more expensive relying on third parties resulting in additional fees incurred.

Supported Assets (Click to minimize)

![]() 1inch

1inch

![]() Aave

Aave

![]() Cardano

Cardano

![]() Algorand

Algorand

![]() ApeCoin

ApeCoin

![]() Aptos

Aptos

![]() Cosmos

Cosmos

![]() Avalanche

Avalanche

![]() Axie Infinity

Axie Infinity

![]() Bitcoin Cash

Bitcoin Cash

![]() Binance Coin

Binance Coin

![]() Bitcoin

Bitcoin

![]() Binance USD

Binance USD

![]() Pancake Swap

Pancake Swap

![]() Chiliz

Chiliz

![]() Compound

Compound

![]() Crypto.com Token

Crypto.com Token

![]() Curve DAO Token

Curve DAO Token

![]() Dash

Dash

![]() Dogecoin

Dogecoin

![]() Polkadot

Polkadot

![]() EOS

EOS

![]() Ethereum Classic

Ethereum Classic

![]() Ethereum

Ethereum

![]() Filecoin

Filecoin

![]() Fantom

Fantom

![]() FTX Token

FTX Token

![]() GMX

GMX

![]() The Graph

The Graph

![]() Hedera Hashgraph

Hedera Hashgraph

![]() Huobi Token

Huobi Token

![]() Internet Computer Protocal

Internet Computer Protocal

![]() Icon

Icon

![]() Kusama

Kusama

![]() Chainlink

Chainlink

![]() Litecoin

Litecoin

![]() Luna Classic

Luna Classic

![]() Decentraland

Decentraland

![]() Polygon

Polygon

![]() Maker

Maker

![]() Near Protocol

Near Protocol

![]() Neo

Neo

![]() Harmony

Harmony

![]() Ontology

Ontology

![]() PAX Gold

PAX Gold

![]() Quant

Quant

![]() THORChain

THORChain

![]() Sandbox

Sandbox

![]() Shiba Inu

Shiba Inu

![]() Synthetix

Synthetix

![]() Solana

Solana

![]() Sushi

Sushi

![]() Theta Network

Theta Network

![]() Tron

Tron

![]() Uniswap

Uniswap

![]() USD Coin

USD Coin

![]() PAX Dollar

PAX Dollar

![]() Tether

Tether

![]() VeChain

VeChain

![]() NEM

NEM

![]() Stellar

Stellar

![]() XRP

XRP

![]() Tezos

Tezos

![]() Zcash

Zcash

Supported Assets & Networks

Kucoin has almost 700 different cryptocurrencies listed with most leading crypto assets and token standards supported. It can be said that Kucoin often adopts new and popular crypto assets quicker than other regulated exchanges due to greater freedom to operate without constraints. KuCoin also recognises and supports crypto assets that exist on multiple networks providing clear deposit and withdrawal options for users to engage with a wide selection of networks, transaction types and blockchains.

Getting started with KuCoin

Verification

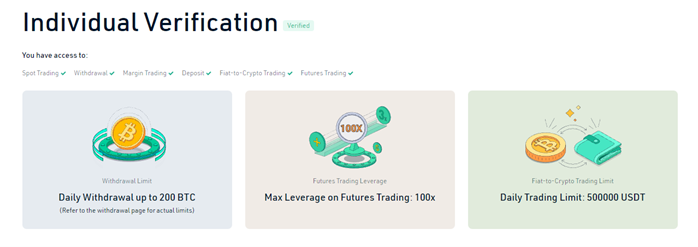

Kucoin has tiers for verification with different applicable limits on deposit/withdrawals and trading. It is possible to operate an unverified kucoin account registering with just an email initial. This account is subject to the lowest security and withdrawal limits. By completing KYC level 1 the account has access to far more trading services, tools, and payment methods by provide personal information, country of residence and ID document details. The higher tier of verification KYC 2 can be granted once the user provides supporting identity documents to verify It is also possible to register for an institutional account with Kucoin by applying using an account at any verification level including unverified. Information such as the corporation registered name, source of funds and tax identification numbers are required.

Limits

KuCoin is one of the only exchanges that currently does not require KYC and non-verified accounts can still trade, stake, send and receive crypto. An unverified account is able to withdraw 1 BTC in equivalent value however withdrawals can be restricted depending on the crypto asset to prevent money laundering. User can get a verified account by submitting basic personal information accompanied with a government issues ID document, which increases account limits to withdraw up to 100 BTC per 24h. There are even higher limits available for Institutional clients that have completed advanced KYC on their account and benefit from up to 500 BTC withdrawals [er 24 hours as standard.

Supported Countries

Kucoin allows users from all over the globe to register and use their services with the exception to a few countries including the US. It is possible for users within restricted countries to register and use KuCoin with an Unverified account however this does have additional risks and support may not be prioritised for support in the case of fraud, theft or hacking etc. It goes without saying that they can refuse or disable any users account for breaching terms of service or for engaging in suspicious activity or refusing KYC or verification. As long as you do not fall into this category there shouldn’t be any issues for users wanting to register and use KuCoin. There is

Is KuCoin Safe?

Regulation

At the time of writing KuCoin is currently unregulated by any financial regulatory agency. The platform is integrated with third party fiat gateways and payment processors that are regulated and as such KuCoin effectively is still required to comply with the applicable financial regulation. Crypto licences and regulation are still somewhat in development and new to the industry, as a leading crypto exchange it would be expected that KuCoin would achieve some regulatory approval soon.

Security

KuCoin prides itself for its high security standards for the assets and data within its care. Users are required protect their account with 2-Factor authentication when logging in and enter a trading password to trade or withdraw assets from the platform. There are also advanced security measures available including IP and wallet address whitelisting. With users being encouraged to complete verification. KuCoin has suffered from a hack of more than $250 million of cryptocurrency from its hot wallets back in 2020. The company acknowledged this publicly and temporarily suspended all deposits and withdrawals before completing its security checks and resuming operations. A significant amount of crypto was recovered after the incident and the fast and thorough investigation and protective measures meant that KuCoin has been able to meet all its obligations to user. Further audits and enhancements to KuCoin own security systems have been put in place since and Kucoin is now partnered with Onchain Custodian, a Singapore crypto assets custody platform with funds backed by Lockton the works largest private insurance brokerage.

Reviews & Reputation Trustpilot

KuCoin since its launch has continued to attract users and become one of the largest cryptocurrency exchanges within the industry. The companies TrustPilot currently has a rating of 1.8 out of 5.0 though it is subject to bombardment of fraudulent reviews. There are genuine reports of users trading and enjoying the platform and features though many have submitted feedback on liquidations, compliance, and accounts being blocked. As KuCoin remains unlicenced there are higher concerns associated with the platform than other more regulated exchanges.

Summary

KuCoin has proven itself reliable and secure exchange committed to supporting and growing the crypto ecosystem. It remains a fairly popular option for users due to its wide selection of crypto assets listed and its wide range of advanced trading tools and features. One of the drawbacks of using KuCoin is that it has struggled to obtain regulatory approval and licences to operate and support fiat within many certain jurisdictions. The KCS Token also remains one of the most favourable exchange tokens on the market and offers significant trading discounts and profit distributions back to users for holding and supporting KuCoin.