Nexo

- 1. What is Nexo?

- 2. Trading

- 3. Staking

- 4. Fees, Banking & Payment Networks

- 5. Getting started with Nexo

- 6. Is Nexo Safe?

- 7. Summary

Table of Contents

What is Nexo?

Nexo is a cryptocurrency exchange, loan and staking platform that providing fast access to a wide range of services for crypto assets. Launched in 2018 the platform grew in popularity through its crypto loans and savings accounts providing users with an interest and return on their assets being held within Nexo. There are over 60 cryptocurrencies supported with returns of up to 12% on Stablecoins, 7% for Cryptocurrencies and 8% for Fiat available for users within the highest staking tier. Nexo operates in over 200 countries and jurisdiction and has achieved a broad set of licences and regulatory approvals. It supports over 40+ fiat currencies with advanced trading and funding options for USD, EUR, and GBP. The NEXO token serves an important part of the ecosystem with users receiving a wide range of benefits for holding and choosing to receive interest payments in NEXO.

Nexo Trading

Convert

Nexo provides users with an easy-to-use convert function that exchanges one crypto asset for another automatically without needing to use the trading platforms. This can be done from either Savings or Credit line wallet and both Fiat and crypto assets are supported. It is worth noting that not all assets and trading pairs are direct so more than one conversion maybe required if swapping between multiple altcoins. This also may have additional fees included in the spread of the asset so for the most optimal executing using the Nexo Pro trading platform is advised.

Buy with Card

Nexo users can link Debit/Credit Cards to their account and purchase crypto assets directly. It is possible to make payments in GBP, EUR, or USD and both Visa and Mastercard are supported. Though it does cost more than funding the account directly via bank transfer card payments can be quicker and more convenient. This service starts from as little as $10 making it a great option for purchasing lesser amounts of cryptocurrency.

Boost

Nexo allows its users to borrow against their assets and funds within the account and trade with up to 3x leverage. It is not possible to withdraw or claim staking rewards on leveraged assets as they are intended for trading purposes only. The interest rates on borrowing assets range from 13.9% to 6.9% depending on the loyalty tier of the account.

Nexo Pro

Nexo Pro is the latest addition to the ecosystem, providing users with an advanced trading interface and access to markets for all listed crypto assets. By simply moving assets from within main to pro there is no need to withdraw assets to an exchange to get the same liquidity fees and pricing. It is possible to execute market, limit and stop loss orders and some futures markets are also supported.

Nexo Staking

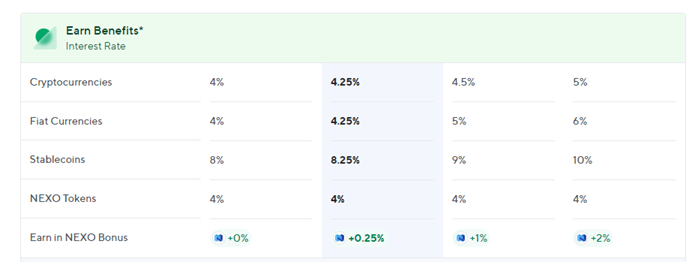

Nexo rewards and rates for staking and lending services are based on the user’s loyalty level. The different tiers are based on the percentage of NEXO that makes up the user’s portfolio and total assets. There is no requirement to purchase any NEXO to get started as you are still eligible for interest on your assets even when within the lowest Base tier. Platinum tier users with 10% of their portfolio being held in the platform in Nexo can receive up to 12% interest on stable coins and the highest yields on fiat and cryptocurrency.

Nexo Earn is paid out to your account daily in the crypto asset, stable coin or fiat currency that is being held and is eligible for rewards. The interest rates vary between the different asset categories with Stablecoins including USDT and USDC generating the highest returns. Fixed staking is also available for crypto assets and fiat currencies though there is currently no option for stable coins. There are options available to lock assets over a 1 or 3-month period with higher interest rates and returns that holding assets normal in flexible. Nexo recently made the decision to remove Earn features for US customers making the opportunities far more limited. This was in response to the SEC’s settlement with BlockFi for engaging in the same activity and was to avoid aggression from US regulators

Crypto Lending

Nexo also allows users to take out loans and borrow against their balansces of crypto assets and fiat currencies. The value that can be borrowed depends on the underlying asset with major stable coins having high loan to value ratios and less established cryptocurrencies receive less value than borrowing. When assets within NEXO have been borrowed against they are no longer eligible for earn pay-outs. If the value of the collateralised asset reaches 0% your assets may be sold to cover the loan repayments and value automatically.

The following rates are estimated and assume the account is within Platinum Tier and elligable for the highest returns available.

Fees Banking and Payments

Trading

The trading on Nexo vary depending on the service and payment method being used. While Nexo Pro enjoys cheap trading fees of 0.10%, the fees for card payments are 1.49% for EU based customers and accounts and 3.49% for non-EU countries. While using the convert feature users will be charged around 2.1% for the order but this car vary greatly depending on the crypto assets selected for the trade, available liquidity, and market conditions.

Withdrawal/Deposit

Depending on your account’s loyalty tier, Nexo will allow you to withdraw a certain number of transactions a month for free and at no cost. This is a great feature especially for those that do not need to frequently move assets as you can get up to a maximum of 10 per month if within Platinum tier. It is free to deposit crypto into Nexo and if you exceed the amount of free withdrawals per month you are charged a transaction fee based on the coin and network being used at market rates.

Fiat and Banking

Nexo is one of few platforms that has support for direct fiat account funding provided by its regulatory and banking partners. It is possible to connect any Visa or Mastercard to your account to buy crypto instantly however this method cannot be used to fund the account to trade with only instant purchases. Card payments also will always settle in USD, EUR, or GBP but users are able to make payments in over 40 local fiat currencies as well. When depositing funds direct to the account local transfers and swift wire transfers are available at no cost to the user. These funds can be used to trade with on convert, Nexo Pro and can be held and used for staking and borrowing services.

Supported Assets (Click to minimize)

![]() Bitcoin

Bitcoin

![]() Ethereum

Ethereum

![]() Nexo Token

Nexo Token

![]() XRP

XRP

![]() Binance Coin

Binance Coin

![]() Dogecoin

Dogecoin

![]() Tether

Tether

![]() USD Coin

USD Coin

![]() Solana

Solana

![]() Cardano

Cardano

![]() Polygon

Polygon

![]() Polkadot

Polkadot

![]() Avalanche

Avalanche

![]() Kusama

Kusama

![]() Cosmos

Cosmos

![]() Near Protocol

Near Protocol

![]() THORChain

THORChain

![]() Fantom

Fantom

![]() ApeCoin

ApeCoin

![]() Litecoin

Litecoin

![]() Bitcoin Cash

Bitcoin Cash

![]() Stellar

Stellar

![]() Tron

Tron

![]() EOS

EOS

![]() Chainlink

Chainlink

![]() PAX Gold

PAX Gold

![]() Aave

Aave

![]() Binance USD

Binance USD

![]() Dai

Dai

![]() PAX Dollar

PAX Dollar

![]() TrueUSD

TrueUSD

![]() Axie Infinity

Axie Infinity

![]() GMX

GMX

![]() Decentraland

Decentraland

![]() Sandbox

Sandbox

![]() Uniswap

Uniswap

![]() Sushi

Sushi

![]() Gala

Gala

![]() Curve DAO Token

Curve DAO Token

![]() Maker

Maker

![]() 1inch

1inch

![]() FTX Token

FTX Token

![]() Huobi Token

Huobi Token

![]() The Graph

The Graph

![]() Compound

Compound

![]() Synthetix

Synthetix

![]() Chiliz

Chiliz

![]() Aptos

Aptos

![]() Osmosis

Osmosis

Supported Assets & Networks

Nexo supports a wide selection of cryptocurrencies that users can buy, sell, stake, and borrow against. There are 41 crypto assets which have all services supported and include most major and established coins. There are a further 12 supported Cryptoassets that users are only able to buy and sell with deposit and withdrawal functionality not being available yet. Nexo is always on the lookout and proactively adds new assets to its platform announcing this on social media and to its customers.

Getting started with Nexo

Verification

It is a requirement on Nexo to complete user verification before being able to receive rewards on any assets being held on the platform. This generally only takes a few minutes to complete however you may need to provide further documents if the verification was unsuccessful. Nexo is required to obtain and verify personal information including Source of Funds and Employment. You also have to complete a face scan and provide a government issued ID document and Proof of Address to achieve the highest limits.

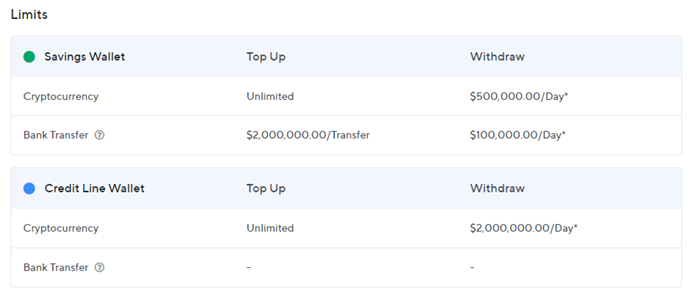

Limits

Nexo allows verified users to take advantage of high deposit and withdrawal limits for both crypto and fiat currencies. Depositing crypto is uncapped and withdrawals set to $500k in value per day which is among the higher default limits available with verified accounts. It’s also possible to deposit up to $2 million via bank transfer and withdrawals of up to $100k per day. Nexo may be able to increase these limits further with enhanced account verification by contacting them directly.

Supported Countries

Nexo is permitted to provide most of its core services to customers in over 200 different jurisdictions globally. There are a few exceptions to this however and Nexo is not supported in: Bulgaria, The Central African Republic, Cuba, Estonia, Iran, The US state of New York, The US state of Vermont, North Korea, and Syria.

Is Nexo Safe?

Regulation

Nexo and its group of companies operate legal entities in many different locations worldwide. Nexo operates and has achieved regulatory approval and licences in the following notable jurisdictions: United States, Canada, Seychelles, Switzerland, Hong Kong, Lithuania. Their approach to compliance and regulations is vast and robust able to provide services in the most efficient manner and ensure a hedged to changes.

Security

Nexo prides itself for its security standards, publicly and transparency detailing its internal policies for asset and risk management. It has secured strategic partnerships with leading custody companies BitGo, Ledger Vault and Bakkt to provide insurance protection of up to $775 million worth of assets in its care. Further to this Nexo’s enforces strict overcollateralized lending practices to ensure its never overexposed and takes on any debt or loss. There is also real time auditing conducted by top 25 account firm Armanino LLP, which further installs confidence in Nexo’s ability to always meet its client obligations. Users are also able to secure their accounts and funds with additional security measures such as 2 factor authentication. Biometric identification and wallet address and IP whitelisting.

Reviews & Reputation Trustpilot

Nexo currently maintains one of the strongest Trutstpilot ratings of any crypto company. Its currently enjoys a rating of 4.5 out of 5.0 with over 10,000 reviews demonstrating its customers overall believe it provides an excellent service and platform. There is the occasional negative review usually referencing account closure or an unforeseen liquidation, but these are few and far between and can be expected for a platform like Nexo.

Summary

Nexo has proven itself to be one of the best crypto loan and lending platforms in the crypto industry especially in recent history with Celsius and BlockFi suffering from liquidity issues. Their prioritised approach to regulation, security, collateralisation, and user protection has allowed Nexo to maintain and continue its growth of market share despite external concerns about crypto businesses of this nature.